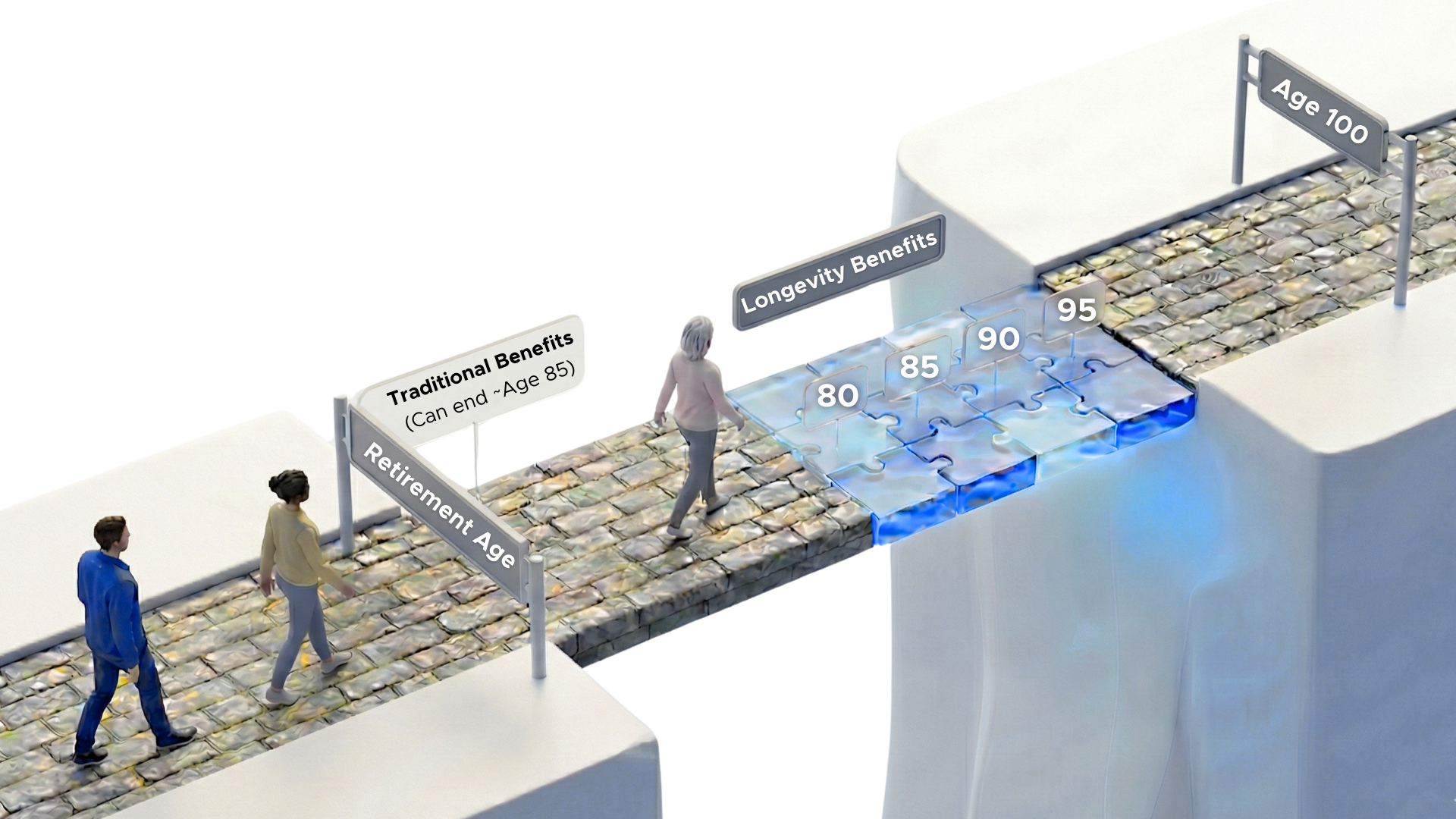

Savvly helps protect you from the risk of outliving your money.

.png)

*Hypothetical illustration. Not predictive of future results. Payouts depend on market performance, participant longevity, and redemption activity. Individual outcomes will vary. See Assumptions & Disclosures.

.png)

Incredible breakthroughs are going to lead to longevity escape velocity… By roughly 2032 when you live through a year, you’ll get back an entire year from scientific progress.

- Ray Kurzweil

.png)

*Hypothetical illustration. Not predictive of future results. Payouts depend on market performance, participant longevity, and redemption activity. Individual outcomes will vary. See Assumptions & Disclosures.

*Hypothetical illustration. Not predictive of future results. Payouts depend on market performance, participant longevity, and redemption activity. Individual outcomes will vary. See Assumptions & Disclosures.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value. Savvly products involve risk including possible loss of principal. Past performance does not guarantee future results. This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own advisors regarding your specific situation.