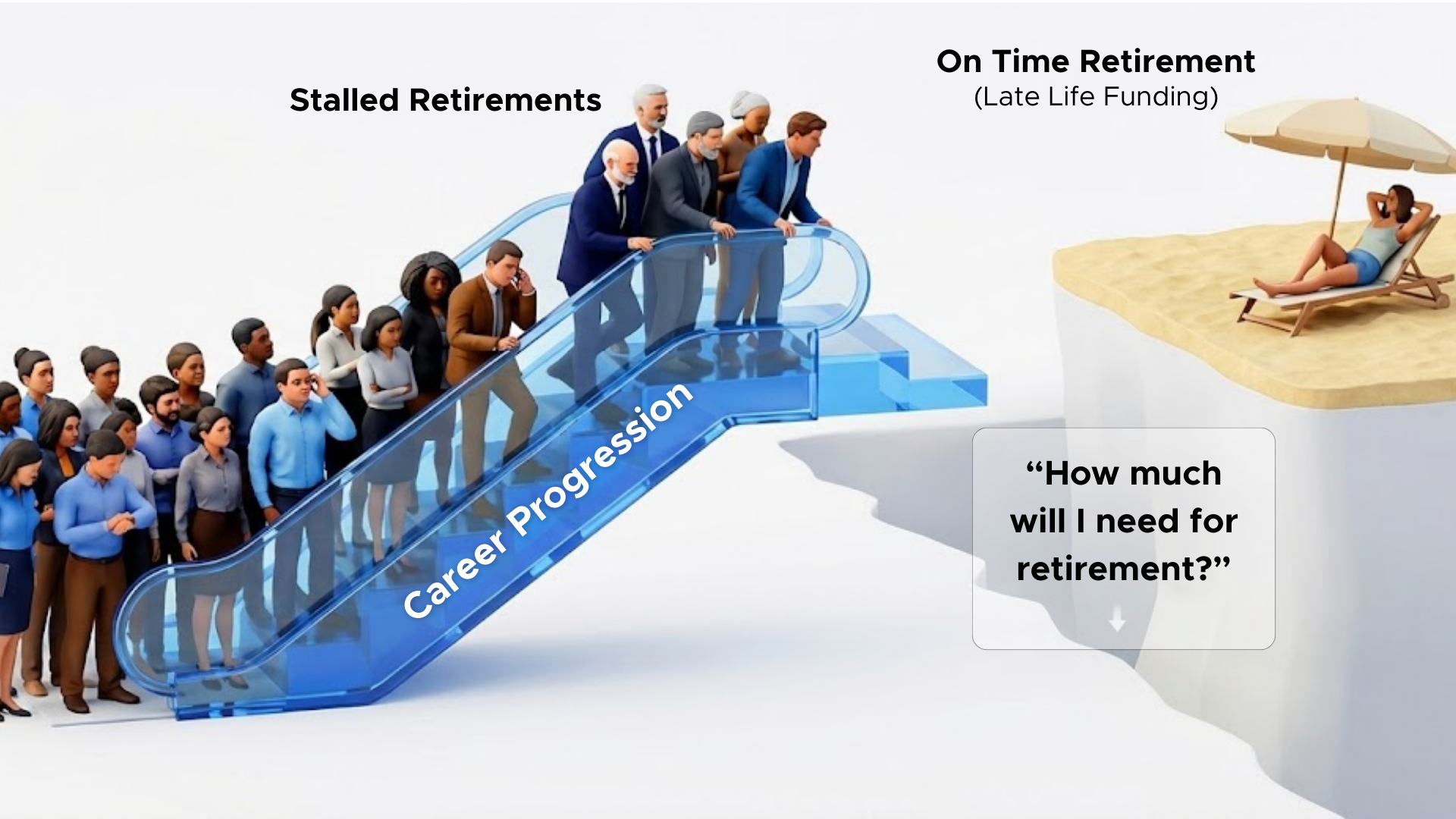

The Savvly Longevity Benefit reduces the high costs of your aging workforce by helping employees retire on time.

Current retirement benefits often don't support longer lifespans, creating financial insecurity that forces many employees to delay retirement.

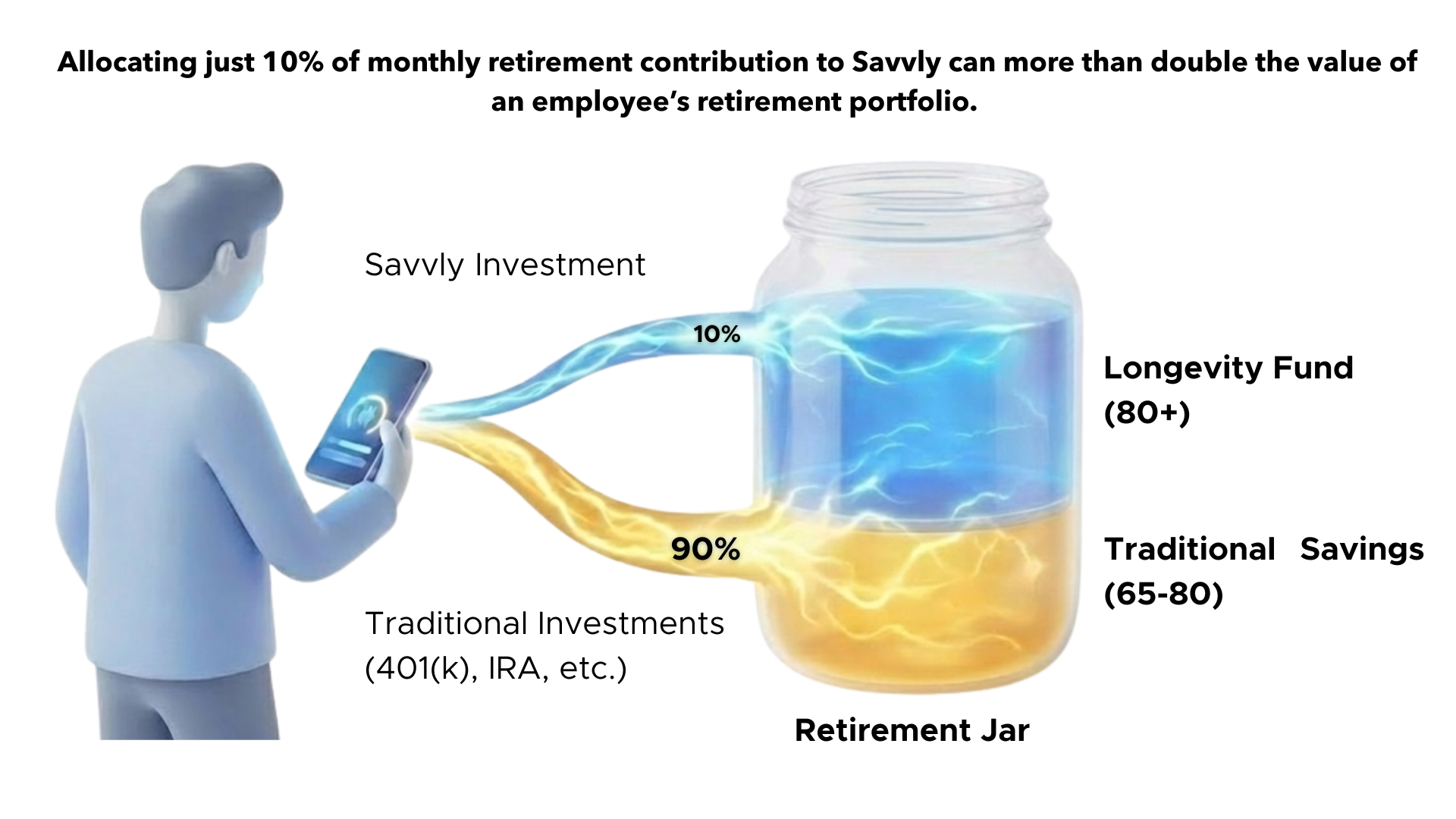

Hypothetical illustration. See Assumptions & Disclosures.

When senior roles stay filled, your best talent leaves because they see no room to move up.

Higher numbers of senior employees leads to higher healthcare, insurance, and salary expenses.

Workplace injury claims and age-discrimination lawsuits are more complex and harder to settle for senior employees.

Hypothetical illustration. See Assumptions & Disclosures.

Savvly helps your team feel financially stable, so they can focus on doing their best work. Give your employees increased spending power now, with financial confidence in their future.

Savvly helps employees retire on time, lowering salary creep, healthcare spend, and mobility bottlenecks.

With long-life support built in, employees feel more protected as they plan beyond their working years.

Predictable retirement opens space for career progression, creating healthier movement up your organization.

A benefit that signals genuine care gives employees more reason to stay, grow, and contribute at their best.

Hypothetical illustration. See Assumptions & Disclosures.

Savvly works with the platforms you already use, making setup fast, easy, and frictionless. There’s no need to overhaul systems or retrain teams. We plug right into your companie's existing payroll and HR platforms, and handle the onboarding so you don’t have to.

See how longevity benefits could improve employee outcomes, reduce retirement delays, and strengthen financial well-being across your organization.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value. Savvly products involve risk including possible loss of principal. Past performance does not guarantee future results. This material is for informational purposes only and should not be construed as financial, legal, or tax advice. You should consult your own advisors regarding your specific situation.